DECATUR, Ga. – As many residents are preparing to travel this summer, DeKalb County Tax Commissioner Irvin J. Johnson is reminding vehicle owners to check their registration before the Fourth of July holiday.

“Driving with an expired car tag or without a tag can impact your travel plans and cost you valuable time and money. Whether it's local or long distance, ensuring your vehicle registration is current should be on your travel checklist before any road trip,” said Tax Commissioner Irvin Johnson.

Tags can be renewed online, at a kiosk or any three tax office locations. For walk-in service at the Memorial Drive office location, customers can expect delays the week before and after a holiday. All tax office locations in DeKalb will be closed for the July 4 holiday and will reopen July 7, 2025.

A valid Georgia driver's license with a current DeKalb County address is required to register a vehicle. Individuals moving to Georgia or moving from one county to another have 30 calendar days to register their vehicles. To update your address on your Georgia driver's license or to find a Georgia Department of Driver Services (DDS) customer service center, visit dds.georgia.gov.

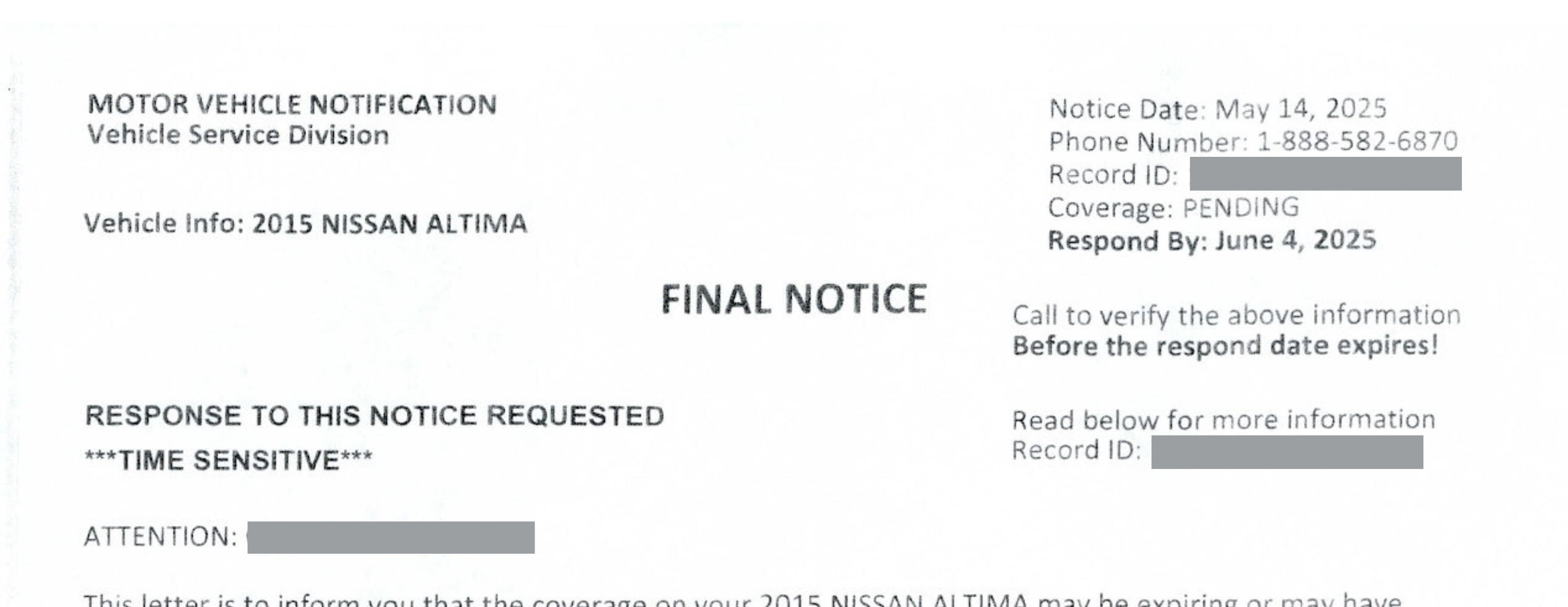

The tax commissioner’s office has recently been notified by customers about letters appearing to be official notification from the motor vehicle division regarding their vehicle registration.

“It’s also important to exercise caution when receiving mail, email, text message or phone call offers that appear to be from the tax office,” said Johnson. “We’re aware of fake vehicle renewal letters, and property tax programs, requiring a fee. When in doubt, if it looks or sounds suspicious and seems too good to be true, I urge DeKalb taxpayers to contact my office. These types of scams can wind up being costly for taxpayers.”

To reach the motor vehicle or property tax division of the DeKalb County Tax Commissioner’s Office, visit DeKalbTax.org or call 404-298-4000.

# # #

About the DeKalb County Tax Commissioner’s Office

DeKalb County Tax Commissioner Irvin J. Johnson, an elected constitutional officer, is responsible for billing, collecting, and disbursing $1.8 billion in personal and real property taxes, and administering homestead exemptions for the nearly 260,000 property owners. Also serving as an agent for the State of Georgia, the tax commissioner handles all aspects of motor vehicle registrations, including managing the collection of motor vehicle taxes, issuing vehicle tags and titles, and processing vehicle registration renewals for citizens and businesses located in DeKalb County, Georgia.

For more information about the Tax Commissioner’s office, please visit www.dekalbtax.org. For updates about the tax office, follow @dekalbtaxga on Facebook, X (Twitter), LinkedIn, and Bluesky.